Inside a cavernous industrial building where the U.S. Navy built hundreds of ships for overseas combat, longtime Bay Area housing developer Rick Holliday is battling a crisis closer to home: the Bay Area’s dire need for more housing.

In March, Holliday’s Factory OS in Vallejo’s Mare Island will begin churning out the hundreds of modular homes it expects to complete in its first year.

After many years of talking about it, developers like Holliday are finally taking major steps to move into modular construction. Soaring construction costs and labor shortages across the region are constricting developers’ ability to meet the Bay Area’s housing demand and hampering attempts to address a rise in homelessness.

Modular construction can help solve these problems: It can cost 20 percent less and take 40 percent less time than standard construction, Holliday said. It’s a huge change for an industry that, for the most part, still constructs buildings the way it did a century ago.

“Three-and-a-half years ago, I made the decision that if we didn’t start building housing differently, our industry was going to be in very bad shape,” Holliday said. “People have hit a threshold where they are saying, ‘My project will never be financeable if I don’t find a more economically efficient way to build it.’”

With developer demand on the upswing, the nascent industry is poised for rapid growth, but challenges stand in the way: opposition from labor unions, negative perceptions about quality and, perhaps the biggest, a lack of suppliers in the marketplace.

Factory_OS’s Vallejo factory.

How it works

Modular construction involves manufacturing sections of a building, known as modules, in a factory. The modules are then shipped to their final destination where they are arranged, stacked and assembled. The most common uses are multifamily buildings and hotels, but they are also used for schools, medical buildings and other commercial buildings.

Modules are completely built out in the factory with floors, ceilings, dry wall, paint, fixtures, appliances and even the toilet paper holder installed, Holliday said.

On site, builders prepare the foundation and infrastructure, then assemble the delivered modules and complete the exterior.

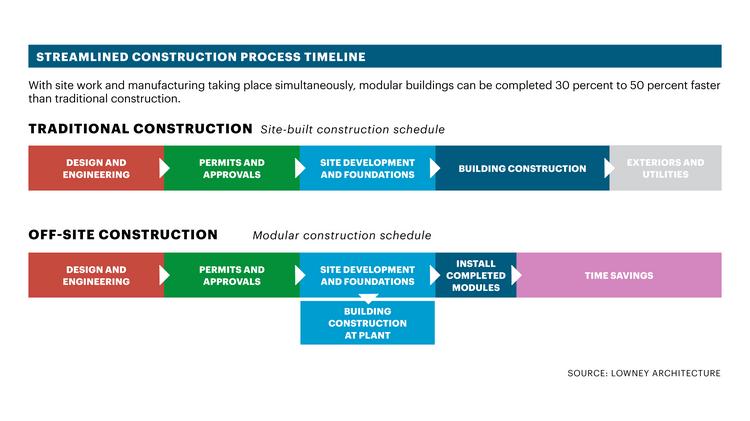

With modular construction, site preparation and module fabrication can take place at the same time, shaving several months off the time it takes to complete a project. That alone is a major incentive for developers.

Modular development only makes up a tiny piece of the overall construction industry — just 3.2 percent nationally in 2016, according to the Modular Building Institute — but it’s growing rapidly. From 2015 to 2016, modular construction projects rose in value by 62 percent to about $6 billion compared with a 40 percent rise in value for all construction projects to $244.5 billion.

Oakland-based developer RAD Urban also set up its own factory in Lathrop in the Central Valley to build out modules for Garden Village in Berkeley, a 77-unit student housing development that was completed in 2016.

Garden Village, a UC Berkeley student residence at 2201 Dwight Way in Berkeley, was built using modular construction techniques.

“We weren’t satisfied with the offerings of manufacturers operating at that time and we saw what a huge opportunity there was if we could do it better,” said Randy Miller, the company’s founder. “Establishing our manufacturing operation has been a huge undertaking, but we had no choice because we couldn’t find any existing manufacturers ready to meet our needs.”

The developer is now taking modular to new heights with two highrise projects in Oakland: a 29-story tower at 2044 Franklin St. and a 28-story tower at 1433 Webster St.

RAD Urban started production about three years ago at the 118,000-square-foot Lathrop factory and so far has made about 400 modules as it fine-tuned the process. Miller expects to ramp up to 1,000 modules per year and already has contracts to build about 2,500 units in the next few years.

RAD Urban completed a 43-unit modular apartment building at 4801 Shattuck Ave. in Oakland .

Building in a factory

Inside Factory OS, a 256,000-square-foot workshop roughly three football fields long and one football field wide, modules will move through more than 30 stations on an assembly line. Holliday estimates that once up and running, at least four modules could roll off the production line each day. At its peak, the factory could produce 1,500 to 2,000 homes a year, and there’s enough space to add a second assembly line.

Before production has started, parties representing more than 35,000 homes have joined the factory’s interest list.

Factory OS is fully booked up for the first year with projects including studios for formerly homeless people in West Oakland, 110 apartments for a Holliday Development project at 532 Union St. in West Oakland, and 300 homes for tech giant Alphabet, the parent company of Google.

The order from Google served as a catalyst for Holliday to consider not just using modular housing, but also manufacturing it.

Back in 2015, Holliday had hired now-shuttered modular pioneer Zeta Communities to build 136 apartments at 5880 Third St. in San Francisco’s Bayview district.

Around the same time, Holliday met with Google, which like many large employers was looking for innovative and affordable strategies to provide housing for workers. Its executives agreed to come on board as a customer if Holliday started a factory. Google placed its order last summer.

After scoping out sites in West Oakland, Holliday ended up taking space in Mare Island and calling the venture Factory OS for “off site.” To start Factory OS, Holliday used his own money and then raised a little more than $10 million from investors. His startup costs so far are around $3 million to outfit the factory with equipment, offices, materials and 50 workers who are affiliated with a carpenters’ union.

“We’re taking a very, very conservative approach to starting this factory,” Holliday said.

Pioneers

During the past decade, less than a dozen modular housing developments have been built in the Bay Area, but many more are in the pipeline.

Most of the completed modular multifamily developments were produced by the Zeta Communities factory in Sacramento or Boise, Idaho-based Guerdon Enterprises LLC.

Zeta, founded in 2007, went out of business in 2016, casting a shadow over the modular housing industry. Its founder, Naomi Porat, left in 2011. She now serves as a strategic adviser for Factory OS.

“I founded Zeta in 2007 to provide a lower-cost, higher-quality and more efficient construction method for multifamily housing developments. At that time I recognized that modular housing could transform the industry,” Porat said. She remains a believer in modular.

“In the near term, we will see demand from developers outstripping factory capacity,” she said. “This inflection point is an optimal time to invest in factories.”

Zeta built the modules for the first modular project in San Francisco: Panoramic Interests’ 23 units at 38 Harriet St.

The project, completed in 2012, created a splash for its use of modular and also its micro-unit design. The developer quickly master-leased the units to the California College of the Arts for student housing.

Patrick Kennedy, head of Panoramic Interests, blazed a trail for modular development with 38 Harriet, but has since moved to the sidelines while more manufacturers come online.

“We don’t like being the first using a new technology,” he said. “The first guys on the beach always get shot up. We want to be in the second boat or the third.”

Patrick Kennedy, CEO of Panoramic Interests

The firm’s project at 500 Kirkham St. in West Oakland, a proposed 1,031-unit apartment building, was designed by Lowney Architecture as modular, but will most likely be built with traditional onsite construction. He approached Factory OS, but would have to join the backlog.

“Modular construction is going to have a significant place in the Bay Area,” Kennedy said. “It’s the only way we are going to have a chance at providing housing at an even remotely reasonable figure.”

Piling into modular

Guerdon, founded in 2001, is one of the more established U.S. manufacturers and produces 800 to 1,000 modules per year that roughly equates to 10 to 12 projects comprising about 1 million square feet. It has produced modules for a handful of developments in the Bay Area.

Most of Guerdon’s work has involved multifamily housing, but the company is increasingly shifting toward building hotels, said Michael Merle, who heads Guerdon’s hospitality division. Developers can fit two hotel rooms into a module using a simple floor plan.

“Hotels are a very efficient design for us to be able to build,” Merle said. “On average-size hotels, about 120 to 150 keys, we can save six or seven months on the overall construction timeline.”

The Bay Area in particular is a prime market for modular construction because of the high cost of labor and construction here, Merle said.

“Our labor rates in Boise are half or a third of the various trades in the San Francisco, South Bay and East Bay areas,” he said. “There’s a hefty transportation fee, but you are able to offset that with the labor costs.”

The result is that Guerdon can deliver a project for 5 to 10 percent less than if it was built on site. Even when the costs of using modular are similar or more expensive than site-built, some customers go with modular to save time and know exactly when and how the units will be built.

Menlo Park-based Katerra, which bills itself as a “a technology company redefining the construction industry,” has also latched onto pre-fabricated construction with a factory in Phoenix.

The company, founded in 2015, said in a statement it has lined up $1.3 billion in construction contracts and raised at least $1.1 billion in venture capital funding, according to Crunchbase. Most of Katerra’s founders and executives come from the technology and venture capital industries, not construction.

“We see an immense opportunity to help move the (construction) industry forward and make construction around the world less expensive and more sustainable, resulting in more housing, at a higher quality, faster, for less money,” said Michael Marks, executive chairman and co-founder of Katerra, in a statement.

The opposition

Where developers see labor and cost savings, construction industry union leaders see potential job losses and the replacement of experienced tradesmen by less-skilled factory workers.

“Modular construction is coming, we get it,” said Larry Mazzola, Jr., business manager for the UA Local 38, Plumbers & Pipefitters, which has 2,500 members in the Bay Area. “We are trying to embrace modular housing, but not at the expense of jobs, building codes, local hire, prevailing wage and apprenticeship opportunities. When you ship a unit in from somewhere, all of that goes away.”

Mazzola has been critical of Factory OS because it only works with a carpenters’ union, leaving out all the other trades.

“Cheaper isn’t always better,” Mazzola said. “Modular housing is crap when it’s built with cheap labor. The modular housing I was talking to (former San Francisco Mayor) Ed Lee about would be good if you have quality craftsmen doing the work.”

He supports a proposal to build a modular factory in San Francisco that the city’s office of Economic and Workforce Development is exploring. The city plans to hire a consultant for $70,000 to study the idea and create a business plan.

One of the city’s goals is to create “middle-income jobs,” said Todd Rufo, director of OEWD.

The feasibility of building a modular factory in San Francisco, where costs of industrial real estate are more than double other parts of the Bay Area, is yet to be seen.

For Holliday, setting up the factory in the former naval shipyard provided a combination of low rent and proximity to the Bay Area — and even the ability to transport modules by barge up and down the West Coast.

“Being accessible to answering people’s queries and engaging in the design of the building is really critical for (customers) to help build confidence in the people they need, whether it’s their bank, political leaders, planning commissioners or design teams,” Holliday said. “The fact that we’re local gives us a big advantage to educate people and help explain what is considered to be a big shift from what people are used to.”

Cutting rents long-term

Using modular construction could lower rents by hundreds of dollars per month, according to a 2017 study from the Terner Center for Housing Innovation at the University of California, Berkeley.

The center concluded that for a sample 900-square-foot apartment in the Bay Area, using onsite construction would result in about $315,000 in hard construction costs. That same apartment would cost $252,000 using modular construction.

“If that cost is amortized at a 5 percent interest rate over 30 years, the rent needed just to cover the cost of construction would be $1,352, or $338 less per month per renter” — a savings of about $4,000 per year, the study states.

The ability to reduce rents could mean that developers can finally deliver housing for middle-income people, said Randy Miller, head of RAD Urban.

“We are in a construction and real estate development market where’s there’s only two type of housing we can build: luxury and subsidized,” he said. “Modular has the potential to change that if we can bring down costs far enough to a middle level that the majority of the population can afford.”

Buying a home from Sears

The idea of making homes in factories goes back more than a century to the days when the Sears, Roebuck and Co. department store sold home kits that were shipped from warehouses and assembled on site.

Decades later came mobile homes or trailer homes, which were designed with wheels so they could be moved. Since the 1970s, homebuilders shifted toward manufactured homes, which are factory-built single-family homes that do not come with wheels.

With modular construction, factories produce individual modules that are fully built out with walls, utility connections, and interior finishes. Modules can contain a fully-equipped home such as as studio apartment or be merged with other units to create larger floor plans such as a three-bedroom apartment. The dimensions of the module are determined by how it will be transported, which is typically on a truck. At Factory OS, modules can go as wide as 16 feet and as long as 74 feet.